Some Known Factual Statements About Eb5 Investment Immigration

Some Known Factual Statements About Eb5 Investment Immigration

Blog Article

Not known Facts About Eb5 Investment Immigration

Table of ContentsSome Known Questions About Eb5 Investment Immigration.The Ultimate Guide To Eb5 Investment ImmigrationThe Basic Principles Of Eb5 Investment Immigration See This Report on Eb5 Investment ImmigrationEb5 Investment Immigration - An Overview

While we strive to use precise and up-to-date web content, it needs to not be taken into consideration lawful advice. Migration regulations and guidelines undergo change, and specific scenarios can vary commonly. For individualized advice and lawful recommendations concerning your particular immigration circumstance, we strongly suggest seeking advice from with a qualified migration lawyer who can supply you with tailored support and make sure compliance with existing legislations and laws.

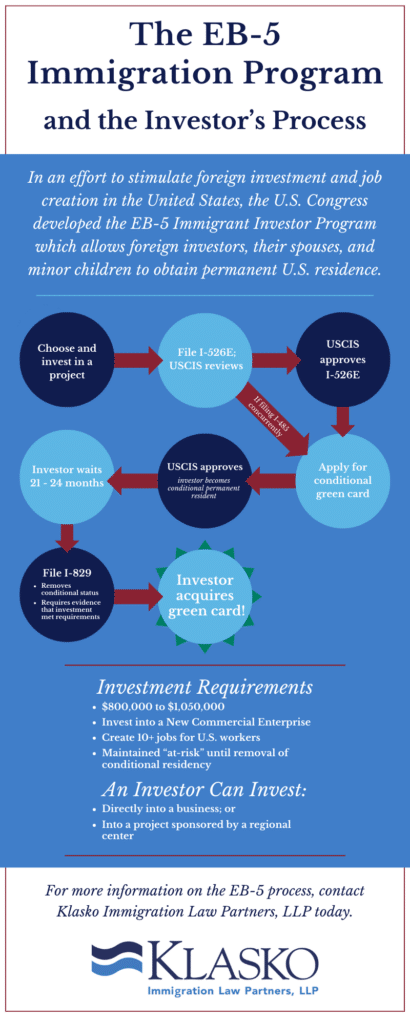

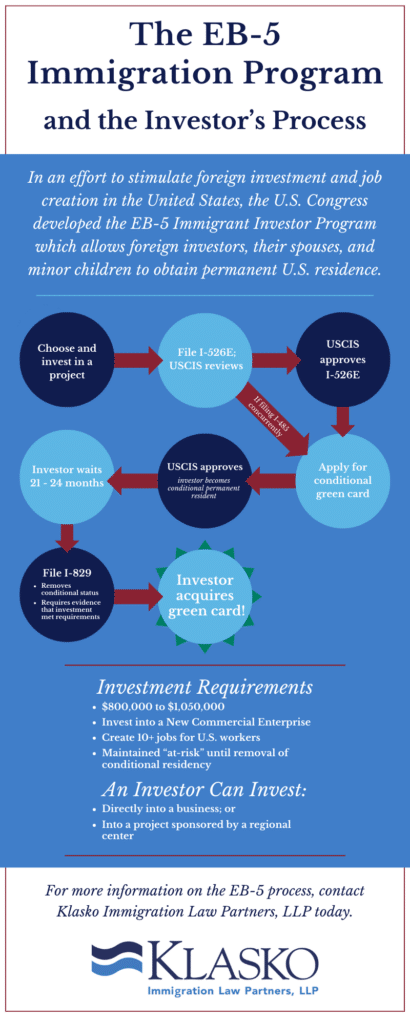

Citizenship, through financial investment. Presently, as of March 15, 2022, the amount of financial investment is $800,000 (in Targeted Employment Areas and Backwoods) and $1,050,000 somewhere else (non-TEA areas). Congress has actually authorized these amounts for the next 5 years starting March 15, 2022.

To get approved for the EB-5 Visa, Financiers need to produce 10 full time U.S. tasks within two years from the date of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement ensures that investments contribute straight to the united state work market. This applies whether the work are developed straight by the business or indirectly under sponsorship of a designated EB-5 Regional Facility like EB5 United

What Does Eb5 Investment Immigration Mean?

These tasks are established through versions that make use of inputs such as advancement costs (e.g., building and devices expenditures) or yearly profits created by ongoing procedures. In contrast, under the standalone, or direct, EB-5 Program, just straight, full time W-2 employee positions within the commercial business may be counted. A vital risk of depending entirely on direct employees is that personnel reductions as a result of market conditions might lead to inadequate permanent positions, potentially causing USCIS rejection of the financier's application if the task development need is not satisfied.

The financial version after that forecasts the variety of direct jobs the brand-new organization is likely to create based upon its awaited earnings. Indirect jobs calculated with financial versions refers to work generated in industries that supply the goods or services to business directly involved in the project. These tasks are created as an outcome of the increased demand for items, products, or solutions that sustain business's operations.

The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

An employment-based fifth choice category (EB-5) financial investment visa provides a method of becoming an irreversible united state citizen for international nationals intending to spend resources in the United States. In order to get this eco-friendly card, a foreign financier has to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Area") and create or maintain a minimum of 10 full-time tasks for United States workers (omitting the investor and their instant household).

This procedure has actually been an incredible success. Today, 95% of all EB-5 resources is elevated and invested by Regional Centers. Considering that the 2008 economic dilemma, access to capital has been tightened and metropolitan spending plans continue to deal with considerable deficiencies. In lots of areas, EB-5 investments have actually loaded the funding space, providing a new, essential source of capital for local economic advancement projects that revitalize areas, produce and support jobs, infrastructure, and services.

Some Of Eb5 Investment Immigration

Even more than 25 nations, consisting of Australia and the United Kingdom, usage comparable programs to attract international financial investments. The American program is more rigorous than many others, calling for substantial risk for capitalists in terms of both their economic investment and immigration status.

Family members and people that seek to relocate to the United States on an irreversible basis can use for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Immigration Provider (U.S.C.I.S.) set out different requirements to acquire long-term residency with the EB-5 visa program.: The very first step is to discover a qualifying financial investment chance.

As soon as the chance has been identified, the financier should make the investment and submit an I-526 petition to the U.S. Citizenship and Migration Services (USCIS). This application must consist of evidence of the financial investment, such as financial institution statements, acquisition arrangements, and company strategies. The USCIS navigate to this website will certainly review the I-526 application and either accept it or request additional proof.

Excitement About Eb5 Investment Immigration

The capitalist has to make an application for conditional residency browse around these guys by sending an I-485 petition. This request has to be submitted within 6 months of the I-526 approval and must consist of proof that the financial investment was made which it has developed a minimum of 10 full-time work for U.S. workers. The USCIS will examine the I-485 request and either accept it or demand added proof.

Report this page